|

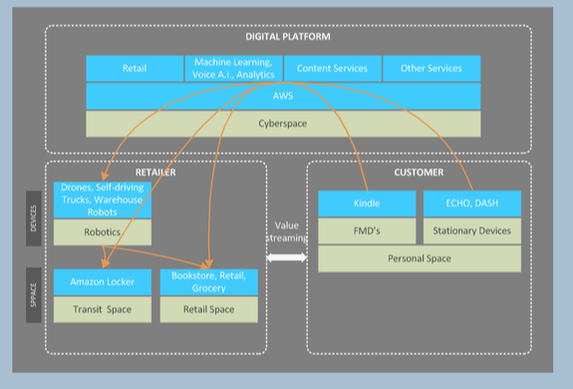

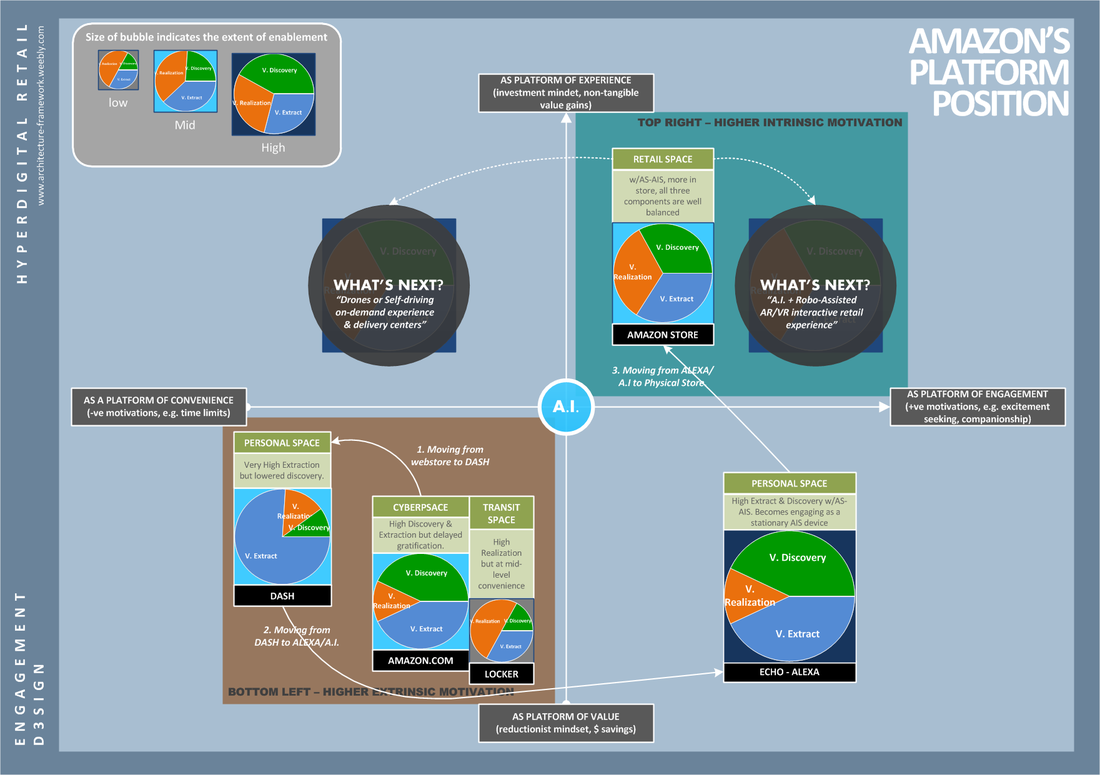

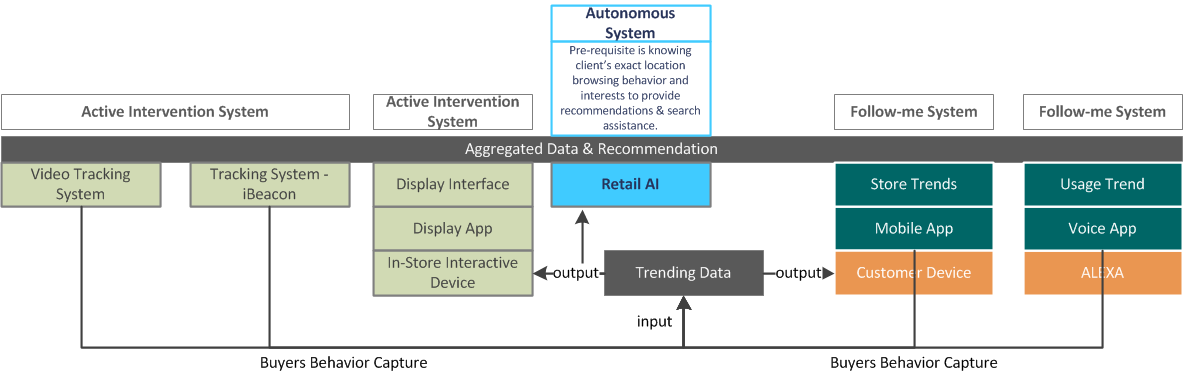

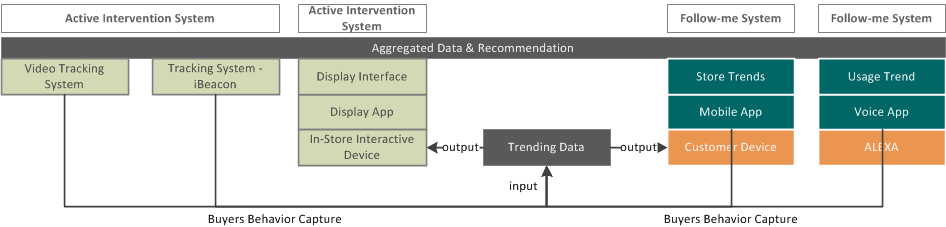

CASE: From E-Commerce to physical Retail - Amazon The move of e-commerce giant into physical retail sparked much media frenzy. Such is the case when Amazon announced the setup of a bricks-and-mortar store. Much of the excitement stem from the expectation that Amazon will enter physical retail in a way that is disruptive - not just from a pricing standpoint but also at how they drive customer centricity. Amazon itself have always been looking at opportunity to have a physical storefront since the early days of Amazon.com but was hampered by the lack of synergistic partnership and changing internal priorities....until late 2016 of course, some 22 years after its establishment in 1994. NOTE: I've covered Amazon's IoT approach in separate blog here. It is easy to see how operating an e-commerce platform gave Amazon a head-start in the digital race - from the easy to use one-click buy to peer review and socialized reading list recommendations. Amazon who used its online book selling strength and expanded into other categories have proven how its capable of evolving around its core strength. I would make Amazon as a case study throughout this post and hope to unravel the architectural elements at play in building a hyper-connected retail concept. I would avoid calling it omnichannel retailing as this term has always been applied in a very narrow view (I'll explain in the later part of this blog). By the end of this blog post, I will present an architectural framework for use in positioning retail in the hyper-digital world. Amazon Retail is Hyper-connected As with most e-commerce sites Amazon started as a webstore and have moved on to engaging customers through smartphones (classified as FMD's in this blog). FMD's (follow-me devices) is increasingly becoming the mainstream engagement platform for many things including e-commerce. Whilst physical retailers build their mobile internet presence, Amazon is taking its first step in the physical retail world by taking 2 approaches: 1. Entering Customers Personal Space - Amazon went on introduced Dash and Echo devices to consumers. By placing physical devices in customer space, Amazon hopes to liberate customer from the need to remember and recall the need to purchase something. This approach offered minimal but meaningful productivity uplift to customers. More importantly usage of these devices shape behaviors, train new habit and eventually drive brand stickiness. These devices enabled value extraction in its most physically convenient way. (read more about value modelling here) 2. Bringing the Experience of Webstore to Physical Retail - Amazon chose to bring the goodness of its webstore experience (an approach I've covered as Value Streaming in a blog post here) into the physical realm. It further assured and strengthened the experience level. This is value discovery and realization for existing Amazon customers. (read more about value modelling here) These new physical devices took the retail world by surprise and introduced a whole new way of shopping - it brought the convenience of the webstore to the physical world! And within customer's personal space! (more about 'space' concept here) By adding a platform layer on top of the webstore and physical world, in the form Alexa and using Analytics to help stream/gain useful information, Amazon builds a 'Platform' overlay to drive engagement. This platform offers a two-way benefit to both customer and Amazon itself. Retail space shifting is now in full swing: Amazon's retail service now exists in customer personal space whilst its physical retail store brings a little of each customer's endorsed shared interest into the actual Amazon physical store. This interconnection very soon builds up to a point when that shared space between retailer and customer becomes significant and 'sticky' too. See diagram below for illustration: Nevertheless, this is nothing new to consumers as they are constantly looking for ways to improve productivity in the personal space. Consider the multiple types of systems you have at home: comfort systems, personal care systems, entertainment systems, etc. These systems gets more sophisticated as technology advances. The advancement itself fulfills needs and it in turn drives dependencies. These systems can be classified into tiered systems: 1. Tier-1: structural systems (SS) 2. Tier-2: passive systems (PS) 3. Tier-3: active intervention system (AIS) 4. Tier-4: autonomous system (AS) NOTE: The idea of tiered systems are first covered here in a separate blog entry. Retailers on the hand have generally been experimenting with AIS systems such as iBeacons, interactive screens, video analytics, dynamic pricing, mobile queuing and checkouts, etc for a while now. However, they usually approach this with the narrow objective of improving in-store sales & marketing operation. It is rarely seen as an opportunity to provide enablement and drive deeper customer engagement. To Amazon, their lack of physical retail presence probably pushed it to launch Echo, Dash and Alexa in the first place. But to a larger extent it was their appetite for continued 2-digit growth that prompted them to push into a new type digital engagement strategy - the hyperdigital engagement strategy. Hyper-digital vs Omni-channel Traditional retailers tend to focus on the 'box' - the physical space. Most strategies that follows need to maximize space use or revenue per square footage. Online retailers tend to focus on how UX can drive retail experience and engagement. They do so by designing a platform that is engagement and brings value by giving incentives or through the value of ecosystem interconnection. Omni-channel retailing typically focuses on pushing inventory via multiple types of channel. Digital in this case is merely an alternate sales/marketing funnel or a customer service channel. When retailer use it as a sales funnel, customer will treat it as no more than a broadcast channel. The effectiveness will be limited. When retailers are obsessed with owning and anchoring the channel to its traditional business model it limits the potential of what digital technologies can truly bring. What retailers need to do is to re-look into the business model with digital - not merely as a place to push inventory or as marketing tool with snazzy UX but as a place of enablement. Only then would digital make sense and are able to unlock the competitive value along with other digital 'allies' such as self-driving vehicles, robotics, consumer-friendly A.I., IoT, a long list of follow-me technologies (e.g. drones, phones, wearables, etc.) and cloud computing . Hyperdigital Retail encompasses a Sense of Fulfillment Retailers often position themselves in a combination of ways, either as convenience driven or experience driven. Both IKEA and Minotti places high emphasis on experience (see the related blog post here) in order to drive brand engagement. For retailers like Tesco or Walmart, the convenience and (economic) value factor ranks high. Even when these retailers go online or omni-channel, the basis of their position does not change. On the other hand, if these retailers want to consider hyper-digital strategy, the approach would be completely different. This would require them to develop a platform of shared and hyper-connected space. Consider Amazon's approach to create a holistic engagement experience, the diagram below illustrates Amazon's unique retail position and movement over the years. At the bottom left of quadrant is where customers mainly needs convenience (e.g. choice, time, distance, processing speed, delivery, etc.) and value savings (i.e. often with a very narrow focus on price alone). In this position, value extraction is the main emphasis. The top right quadrant is when customer seek less tangible form of return. Experience focused customer is those who typically emphasizes life-cycle journey instead of price alone such as skill attainment and accomplishment. Engagement is when customer seek positive motivations such as sense of social belonging, getting the creative boost by discovering new ideas or insights. In this position, value realization and value discovery is of relatively higher importance. Its important to know that the same individual customer can be in all four quadrants depending on the specific needs and offering. Amazon's Platform Position By taking full advantage of its nimble setup, Amazon spent years mastering the art of scaling big, sourcing cheap and selling fast. It did not take Amazon long to realize that there is only so much they could achieve in terms scale and reach if they were just playing at the bottom right quadrant. Without physical storefront, it's difficult to deliver similar shopping experience that physical retailers can achieve. Armed with years of customer insights, Amazon took a major step into physical space retail by introducing Dash and Echo-Alexa devices. The clever move positioned Amazon to quickly scale and engage customer in millions of physical storefronts not owned and maintained by Amazon - by placing Amazon devices in the homes of customers!! Central to the engagement strategy is the use of data analytics and insights to enable Value Streaming. After receiving encouraging results from the earlier device launches, Amazon quickly learned the immense potential of using A.I. and analytics in driving deeper engagement. Not content to just settle in the bottom right position it saw a need to create stronger brand presence and used the earlier advanced knowledge to develop a new physical retail approach. Amazon Bookstore and Amazon Go. Capability enablement is dotted along all the strategic steps taken by Amazon:

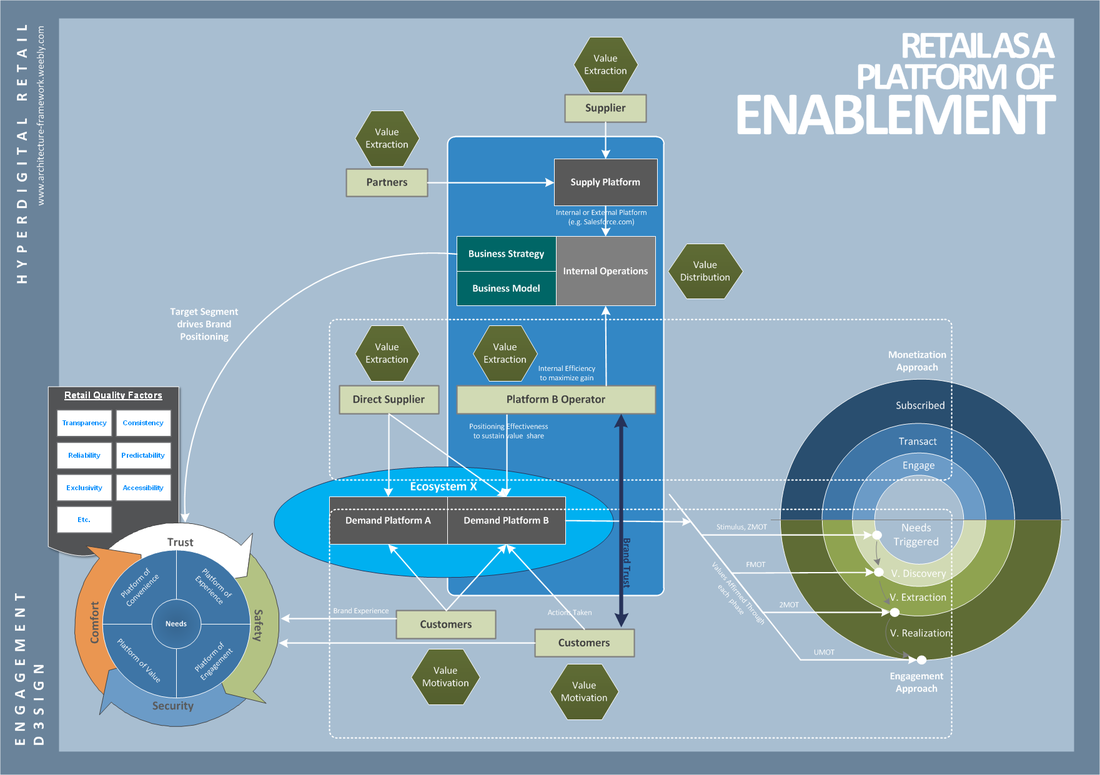

Retail-as-a-Platform of Enablement With the amount of technology available today, we are no longer limited to one specific ways of getting things done. Such is the case for both customer and retailers. Retailers must now be able to adapt and evolve. They must quickly pick and choose the appropriate engagement model. Planning and modelling requires a deep understanding of market and customer. Those who manage to make full use of data and analytics have an improved chance of survival. Those who understand demand & supply, engages deeply and evolves with time improves the chance of sustainability. Those who executes well on all that was mentioned and consciously build value-driven growth will survive, sustain and eventually thrive. The following model provides a starting point for that positioning and planning to take place. Pls. do drop me a mail ([email protected]) for sharing and more insights into the model: FURTHER READS: AMAZON RETAIL

Beyond the aesthetics appeal of the physical store layout, an information rich environment offers unparallelled value. Online commerce provides rich information that is otherwise not captured and harvested in the physical world. By combining its online and in-store appeal, Amazon hopes to build brand loyalty around book buyers who would otherwise only see Amazon as a transparent low-cost delivery channel. Their approach is to use rich data sets from its online store and turn it into a physical world buying experience. With a physical presence, Amazon can potentially capture browsing and reading habit in the physical world as well. This creates immense opportunity for cross-referencing customer behavior in both the online and offline world. Such trending data now enters a self-feedback loop. Traditional RetailIn contrast, traditional bricks-and-mortar retail rely a lot on physical queues (passive systems) and design aesthetics to drive store sales. Information elements are incorporated to provide perspectives but are often ignored by customer with skepticism or irrelevance. In the absence of transparency and community participation, brand building becomes a one-way broadcast exercise.

0 Comments

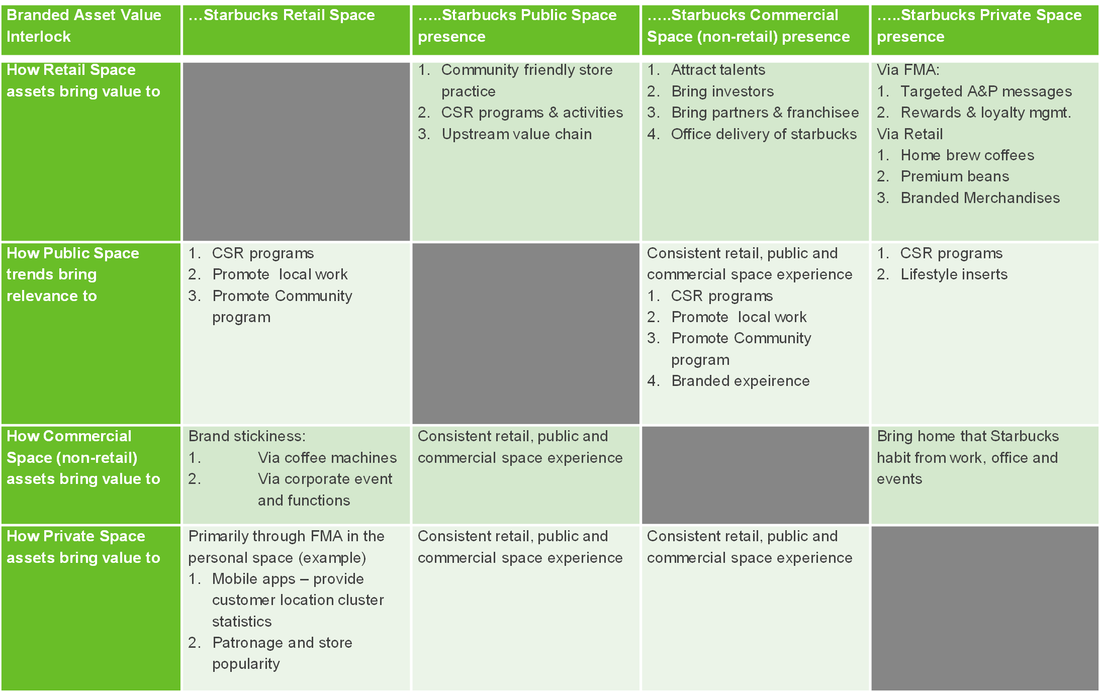

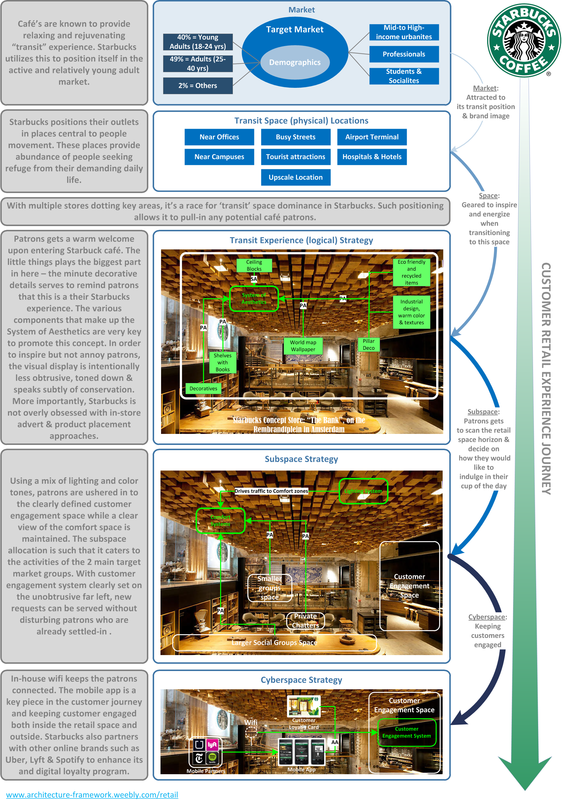

Through this article, we would walk through the case of Starbucks and demonstrate that a synergistic space use strategy enhances the brand experience and draws in partner and investors. To achieve space use synergies, a brand must employee holistic approach that takes into consideration the needs of the target market, promotes and emphasizes customer journey and experience, drive the effective use of technologies in each of the spaces and most importantly have at its core a believe in people, culture and communities. For more article on how a space use strategy head on to: Basic Concept article. The rise of the Space Shifters Space shifting is the act in which a person’s mind switches from one spatial context to another. A person’s mind will normally be operating within the context of the surrounding physical space. However, we sometimes 'drift away' and operate in a different spatial context - for example when we are daydreaming of our next holiday destination. Rich mobile technology and information accessibility is one of the primary space shifting enablers. It is also one of the source of our shorter attention span. Retailers fight hard for an increased attention span as it usually translates into improved attachment between the offered products/services and customer. The attachment would eventually translate into improved sales. Hence, retailers would find ways to keep their customer focused on the offerings and prevent mind drifting. This lead the retail industry to spend a tremendous amount of resources in creating retail experience capable of maintaining attention span. Starbucks targets Transit Space But not all retailers see it as a problem. Some retail businesses sees this as a business prospect. Cafe’s is one of it. Cafe’s have the least problem with people drifting away while sipping their cup of perfect brews. Consider Starbucks and their concept of 3rd home. The successful coffee chain offer us an interesting case study into the use of Space Shifting as a key driver. As a coffee chain, Starbucks provides patrons transitional experience, e.g. a space between office and home; a space for socializing or professional discussion; or a space to revitalize the creative juice. Instead of discouraging mind drifting, a coffee chain like Starbucks is a place to celebrate it. You may argue that, any coffee shop qualifies for that matter. But Starbucks competes more successfully by aggressively negotiating prime real-estate location as it is long proven that a good location acts as a natural magnet. We also know by now that Starbucks not only operates in good locations but it also tends to overdo it by having more than one Starbuck cafes within the same street or neighbourhood. For the purpose of this article, such strategy is not only seen as a way to manage over crowded cafes but also to create more contact points for any potential customers. A Clear Target Market Having a prime real estate alone is not enough. Its very important that retailers such as Starbucks develop a strong understanding of target markets and it's evolving needs. Perhaps the following quotes from Starbucks demonstrates well this understanding. Bill Sleeth, VP of Design at Starbucks in an article with http://www.fastcodesign.com said: "Sometimes when you look at the 'my Starbucks' and the 'that Starbucks,' you’ll see there’s really something different between them," Sleeth says. "The my just feels more comfortable. It feels more natural.” Starbucks clearly transit oriented retail position has to be accompanied with something closer to the customer heart in order for it to really matter to the local community. The Complete Customer Experience Now that the retail space and target market is clear, Starbucks needs an executable action plans to capture that market. With the target market in mind, the other space selection can take place. It is crucial that the selected operating spaces be closely aligned and relates to the values that Starbucks is attempting to represent. Each of the selected target operating space is assigned an objective and connect customers who transits from one space to another. This connection ties up any loose end that ultimately leads to a consistent overall brand experience. The Starbucks customer journey in each of the Starbucks operating spaces can be revealed when mapped into the following matrix: The matrix mainly shows the attribute of each deployed asset in the individual spaces. Effectiveness of brand experience delivery (i.e. actual execution) matters more. It is bad for the brand if user gets an inconsistent Starbucks experience during a corporate event (e.g. rude and unknowledgeable baristas, not environmentally friendly practice, etc.) Space-focused Retail Starbucks retail space is not product centric as most would have thought. It’s strategy and approach is not around the coffee itself, it is centered around patron and customer experience, hence, the retail space is at the very heart of the retail strategy. The retail space is used to engage, inspire and enhance its patrons experience. Each store is created out of a vast selection of design theme and materials. Starbucks gives its designers a selection of both local and global design elements. By recognizing the importance of local elements, they are giving each individual store the needed character and differentiation. The aim is no less than achieving the goal of making every customer visit a “My Starbucks moment”. Ultimately it creates stores that blends in well with the surrounding community. The retail space strategy for Starbucks can be broken into the following components:

The Retail Space Experience The Starbucks approach shows that it is important that retailers look at the evolving needs of customer. However, it wasn’t that long ago when Starbucks only have 4 retail design themes to choose which led to unnecessary design constraints. This in turn compromised customers retail experience with the Starbucks brand. As Starbucks expanded, its in-store experience felt mundane and repetitive. It offered little in terms of transitionary experience and worst felt, uninspiring when a customer move from one Starbucks store to another. This changed when Howard Schultz returned to Starbucks. "We believe a coffeehouse should be a welcoming, inviting and familiar place for people to connect, so we design our stores to reflect the unique character of the neighborhoods they serve. We are also interested in the way design can connect us all to sustainable building practices and provoke thoughtful questions and engagement with the built environment. In addition to reducing energy and water consumption, we incorporate reused and recycled materials wherever possible and often use locally inspired design details and materials in our stores." Starbucks designer references what is known as The Catalogue to create a globally consistent coffee shop design whilst at the same time allow experimentation by designers with local elements to induce the sense that it My Starbucks. Cyberspace Strategy The mobile app program seems to be positioned as its retail companion app. It delivers a set of customer engagement and management capabilities such as customer loyalty and reward management, value representation system, value exchange system, targeted marketing platform, communication channel, etc. On the other side of the coin, the mobile app that started off as a digital value holding system is now slowly being molded into a Starbucks-centric brand experience. Since mobile tech is primarily part of a FMS (follow-me-system) Whilst the mobile app seems to have a more refined strategy and approach, the same could not be said of the web portal. The existing Starbuck cyberspace approach does not have any specific orientation in that it does not appear to be oriented to drive traffics to the retail store. In fact, the site looked a little cluttered and lacks a clear Moving Forward

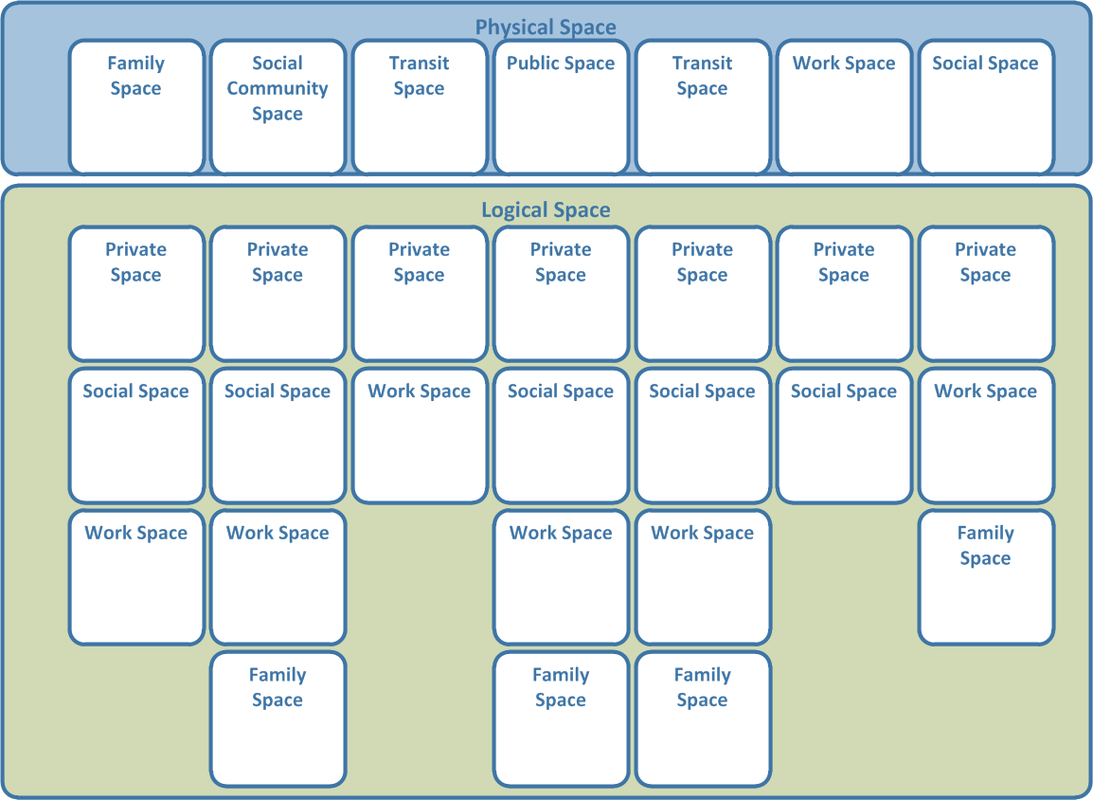

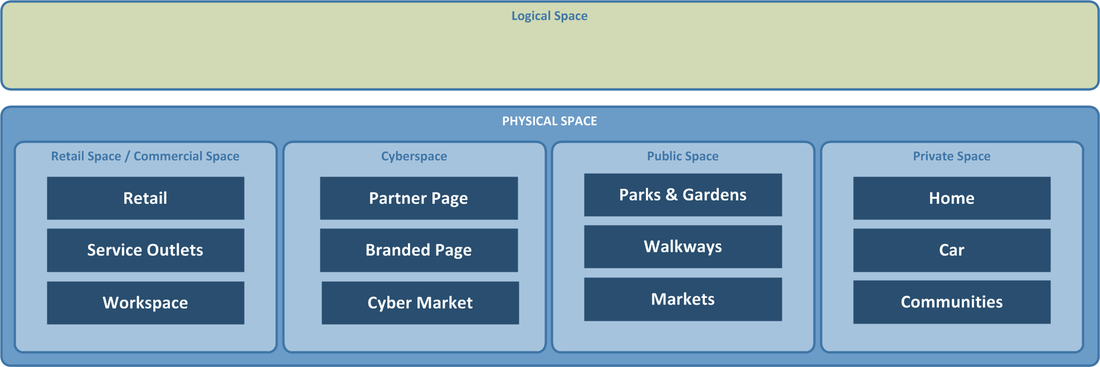

Starbucks strong hold on the market through its sharp focus on customer experience management relies a lot on an integrated approach. Yet, there is much room for improvement. Particularly in the mobile space. with and also how R.3.M.A.G.I.C.S can be combined to position Starbucks in the other spaces (e.g. private, commercial and public space). In the end, maintaining a strong focus on the key market segment and by continuously validating the relevance of its market positioning strategy, It is then worthwhile for retailers to run an assessment on how well is the customer experienced aligned to the brand messaging through its various channels. The framework concepts presented herein references he downstream version of StAF model. It encompasses the space in which people buys/enteprise sells and the space in which people uses or consumes a product. This framework provides a unified approach in understanding the relationship between producer/seller and buyers. The Concept of Space There are 5-main types of spaces:

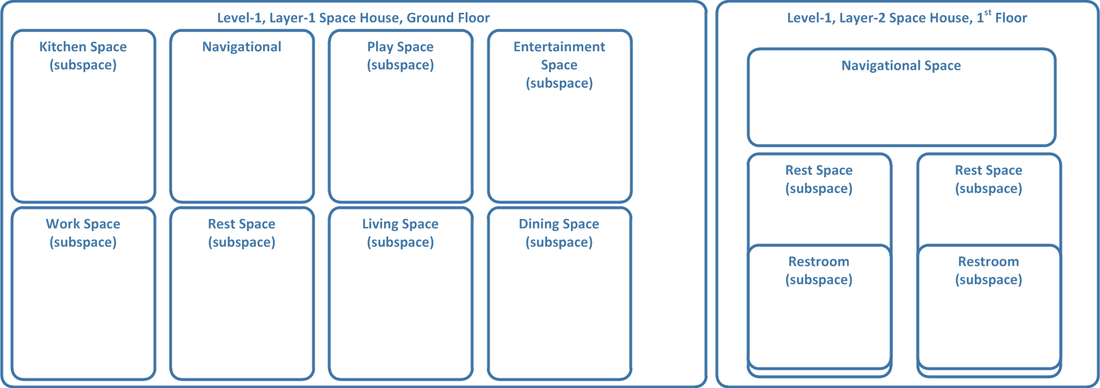

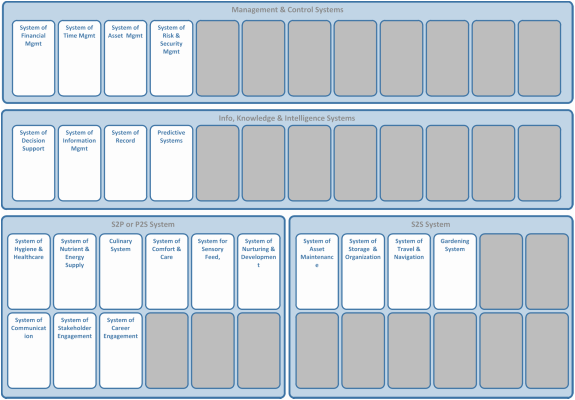

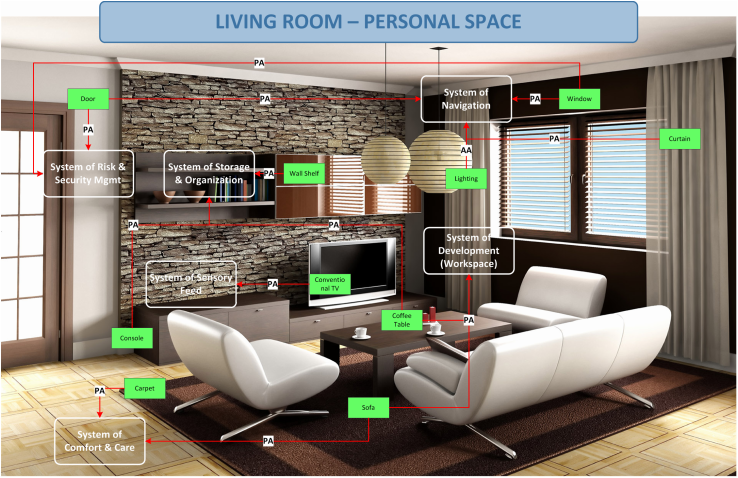

In the highly connected and informed world, we seem to mind shift between spaces. We can read, organize or even participate in social events online while we are working; we read and respond to email and meeting invites while we are at home; we monitor the movement of our little children out of safety concerns regardless of our , etc . Concept of Sub-spaces Spaces (physical or logical) are often subdivided into functional spaces - e.g. living room, bedroom, bathroom, etc. These functional spaces are called sub-spaces. Webpages are divided into contact page, product page, corporate page, etc. Concept of Levels within Spaces or Subspaces A level-1 space provides the platform needed for level-2 subspace to exist. Each subspace can be further subdivided into smaller spaces or will be the platform for "systems" to be hosted. Types of Space There are generally 4 main types of 'physical' space (see diagram below). While a person can be in one physical space at a time, the mind may operate in a logical space separate from the physical space. For instance, you might be in a retail mall staring at an attractive product. Your mind could be wandering off into a personal space where you imagined yourself using the product. The logical space creates relevance between the physical world and the mind. The Concept of Systems While space gives us a concept of people interacting with the environment, the concept of system provides the bridge between human and their environment. Humans have long adapted and mastered the skill of tool making. These very tool now forms the basis of the productivity systems that supports our living needs. With R3MAGICS, the tools that we have forged is again evolving and enabling a highly automated lifestyle. In its origin, our system of intelligence and knowledge is no more than paper and pencils. That has its limitation in adapting to the situation-specific needs. A system is a construct of 3 essential ingredient:

As we shift between spaces, we need the productivity system to follow us into the different spaces. In retail hospitality, some of the systems were supplied to shoppers in the form of Customer Engagement Systems. These were in the form of comfort, caring, entertainment, record, etc. mostly considered as basic to human needs. For instance, Apple IOS new wifi calling feature can be viewed to appeal to the financial management system of a customer as it allows a users to utilize wifi (usually at no charge) to make voice calls. Another example is the increasing popularity of mobile payment solution at retail checkouts. This approach appeals to the customer by improving the following personal system experience:

There are systems that take care of people. There are also system that takes care of system or the environment. Hence:

Types of System

3 Tiers within each System We derive a universal tiering approach in order to classify the type of personal system by borrowing the 3-tier concept from building architecture design. In building architecture, the three tiers are:

We expand on this tiering concept to center around the person itself:

AIS systems must at least have some decision capabilities for it to perform intervention work. In the face of R3MAGICS, AIS system are now bundled with intelligence over the cloud. An Asset (i.e. product) in the Context of System As mentioned in the Concept of System section, an asset (from an ownership viewpoint) or product (from a seller viewpoint) is a key functionality provider within a system. A product can be classified based on its state of readiness (to use):

A sofa as a product asset can participate in multiple systemic roles. Within a given space, it can be part of:

Concept of Space Shifting Prior to the internet and mobile communication technologies, we are mostly passive consumer of services. We are not able reach out to our personal productivity system when we are outside our personal or home space. This however has changed in the advent of the internet and mobile technologies. With consumer bringing along their own devices wherever they go, it is now possible for them to reach out to these personalized systems remotely. This lead to the ability to constantly switch between spaces - e.g. between personal productivity and professional productivity. This creates a phenomenon called space shifting. Customer gets engaged actively with their own personal system. Business have to pursue a social route to continue to keep customers engaged. Concept of Systemic Shift

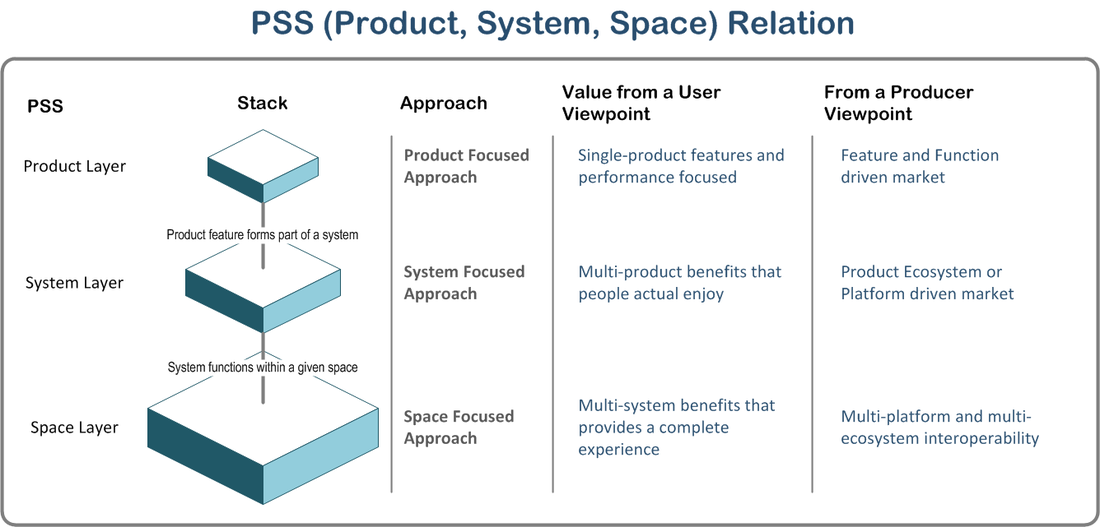

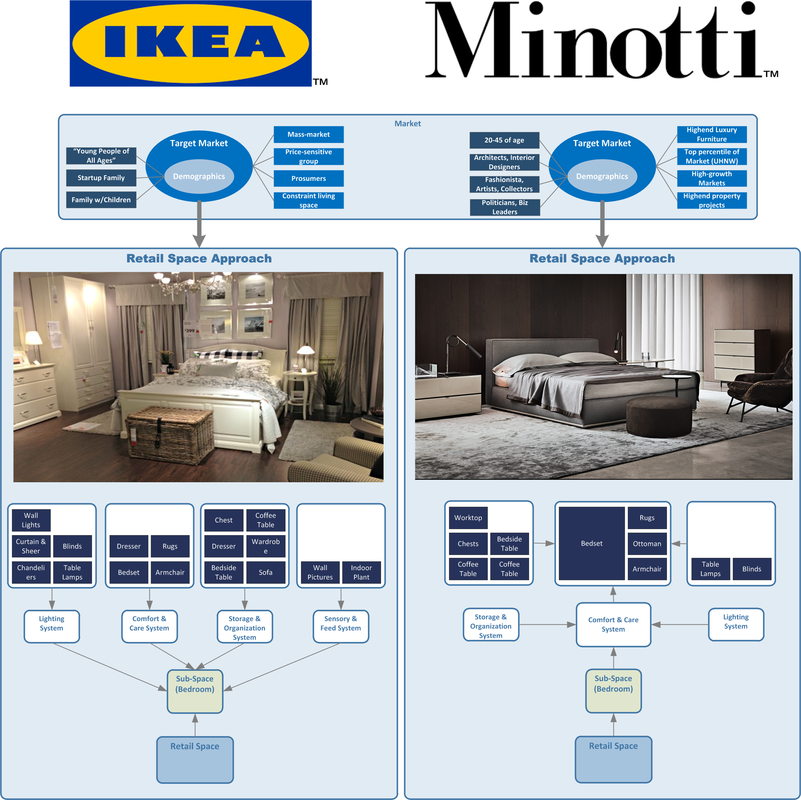

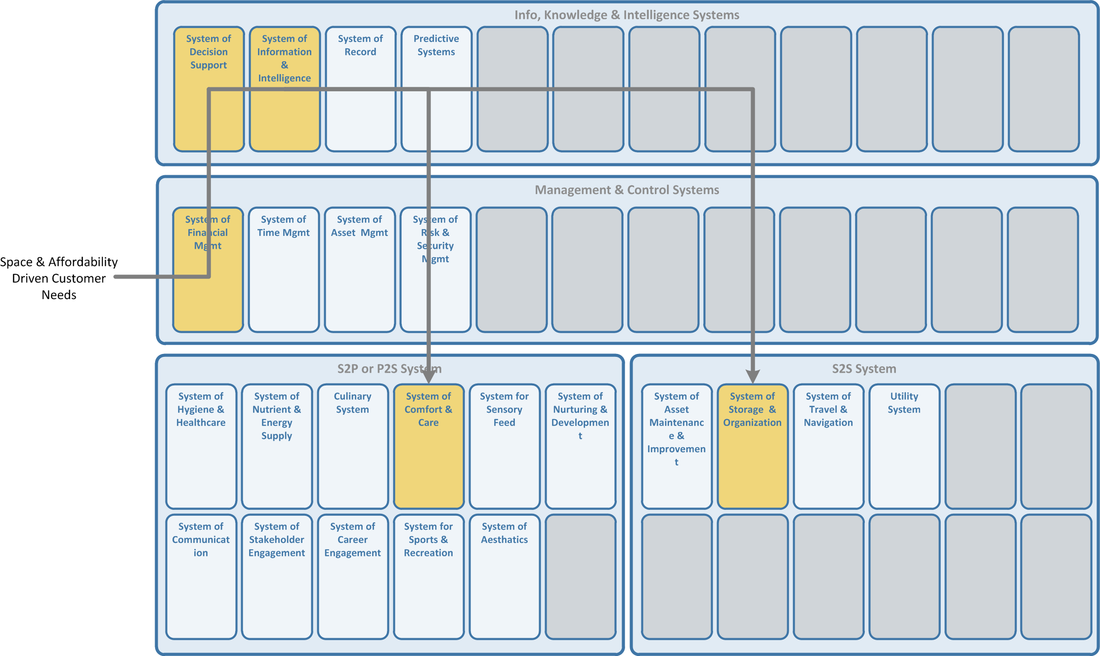

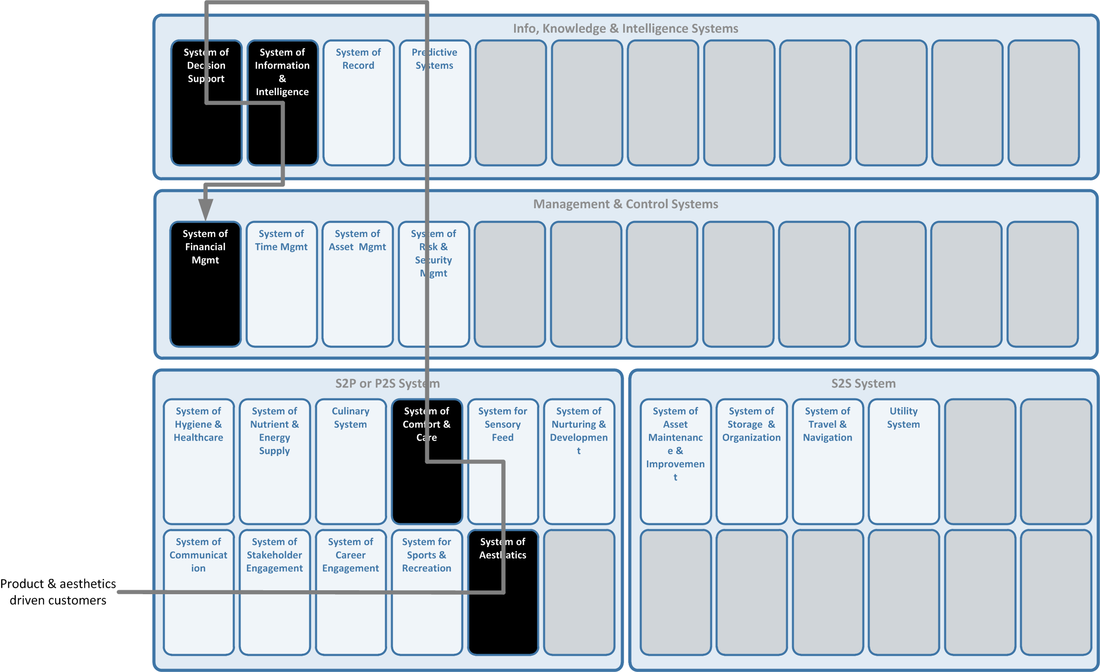

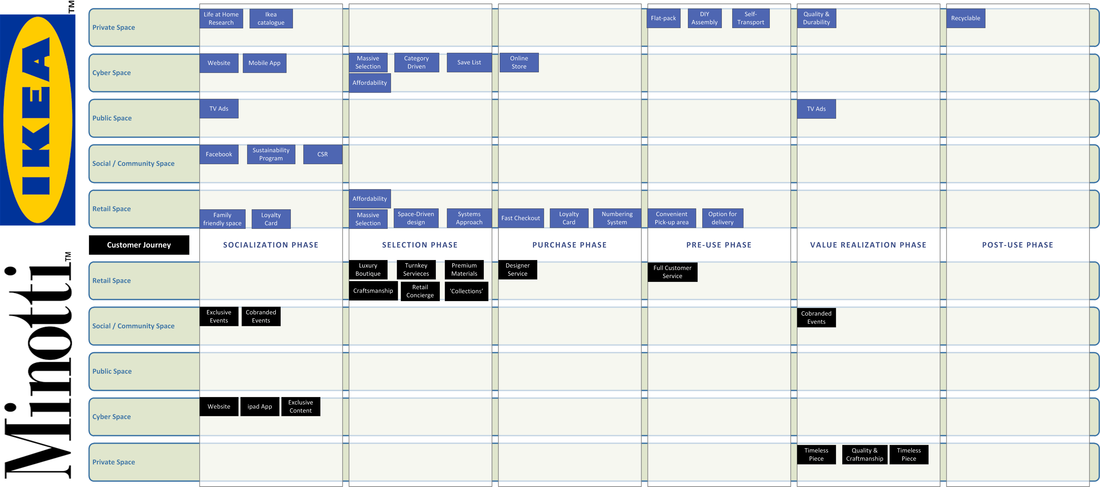

Systemic shift occurs when the systems itself moves to a different tier. A passive system will become an active system by adding a systemic product that is capable of environmental or occupancy detection, decision making and response system. NOTE: This article references the concept presented in an earlier blog post: The Basic Concept We use the concept developed in the earlier part of this blog page to determine how 2 retailers within the same industry positions PSS (product, system and space) differently in order to distinguish themselves and relate to its target market audience. IKEA's Retail Approach Ikea maintains its low-cost quality furniture leadership by tightly integrating and optimizing its entire value chain. In Ikea, products are designed according to its 5 key dimensions (cost, quality, form, function & sustainability). It is usually constructed as modular systems - except for standalone furniture piece. The retail space then takes the product and applies it to spaces that simulates target market real life space use situation. With its target customers mainly being budget conscious and younger family startups, Ikea take the generational challenge to the tasks - e.g. space driven constraint, sustainability, quality products, time starved family, etc. It is then obvious that the retail focus of Ikea has to be around comfort and limited space use. It extends this concept by offering add-on functional products (i.e. wall shelves, storage hooks) that allow customer to continuously improve space use. Ikea's retail operation successfully wraps the space around disparate products to showcase effective space use - thereby creating a sense of relevance and shortens the retail purchase decision. Minotti's Retail Approach Minotti has a very different retail approach compared to Ikea. According to Renato Minotti, their designers considers how people live and work around a sofa. More than just a place to sit, the sofa can be a productive setting. The armrest can replace the side table and the back hold a reading lamp. Minotti explained, "With its technology, you can either lift the arms and the back. It (sectional sofas) can even host 20 people here and you can have a party. You can combine it many ways to fit in the room. You can put your feet up or use it as a side table. " Minotti creates collections (e.g. a table, sofa, armchair or carpet) where by the fabric and other elements speak the same design language. This intensely product-as-system focused approach meant that the entire space is warped around the product. With the target luxury segments, Minotti is driven to push the single product value proposition p to the roof - hence, a product driven retail space approach. The space itself is meant too accentuate Minotti's furniture piece, thereby making the retail strategy a product-centric strategy. Ikea's Retail Space display approach compared to Minotti's Ikea's Probable Target Customer Systems Decision Path Ikea's customer will likely be concerned with space or affordable furniture piece or a combination of both. Their visit to Ikea's showroom will set them on a space organization exploration path. In which they will discover how to create comfort and a sense of organization - despite ever diminishing space, using Ikea's products and systems. Minotti's Probable Target Customer Systems Decision Path Minotti's customer is most likely aesthetic driven (the premium and classy look and feel). With its retail space designed to amplify the value perception of its product, a customer would very likely leave the showroom feeling inspired. An emotionally charged customer will likely keep this positive sensation and ensure that the design of their room space is in sync or conforms to the needs of its product piece or vice versa. Financials are usually not the major concern of Minotti's client base. Other Space Use Strategy Gillian Drakefort, Ikea Country Retail Manager, UK have noted that the online business in UK now makes up 10% of overall sales. The retail sales have had 5% increase in visitors over the past year. She claims that the cyberspace approach by Ikea has created complimentary outcomes in its retail operations. Ikea (depending on region) allows online purchase. Ikea have recently strengthened its cyberspace dominance by allowing customer to use the mobile app as a tool for augmenting furniture pieces in their desired room in real time. For Minotti, everything it does is about amplifying the brand experience to its customer. It does not sell products online and would prefer a more controlled physical retail experience. In recent years, it has experimented with digital medias such as online catalogue over the more premium experience offered in Apple's Ipads. Its digital expansion is carefully curated as not to erode the brand value and dilute its retail store experience. The other interesting cyberspace approach by Minotti is how it approaches the System of Intelligence needs of its high-end clients. For this, they actually allow designers and architects to download and use its CAD models - true to its target market client needs. In the public or commercial space, it even host or co-host private launch events. The events are usually for target groups such as actors, architects, art collectors, fashionistas, business leaders, etc. Space Shifting Customers Retailers needs ensure that their target clients are not in the mode of space shifting whilst visiting any of the space that they are operating in. To do so, the retail formats needs to have the systemic feature and format that attracts and keeps them engaged. Minotti & Ikea Challenges with R.3.M.A.G.I.C.S

IoT allows the passive and structural assets to become active assets. However, this activation requires careful planning and brand alignment. Since Ikea stands for "affordable contemporary design household goods", Ikea should focus on using the R.3.M.A.G.I.C.S to:

|

BackgroundUsing a combination of StAF and R3MAGICS, this blog post provides architecture analysis of the trend and major players in the retail market. R.3.M.A.G.I.C.S is short for Robotics, 3D Printing, Mobility, Analytics, Gamification, IoT, Cloud and Social platform. It encapsulates the key elements that will change the social-economic fabric in the coming years. StAF is short for Strategy-driven Architecture Framework. ArchivesCategories |

RSS Feed

RSS Feed