The Mass Market SegmentThe millennials (born between 1982 and 2000) who are mostly at prime working age now, are often the focus due to the segments importance in sustaining the chain of disruptions. According to Teaching Financing Tools concept (source: https://www.joe.org/joe/2013february/tt6.php) this group who have a tendency to overuse credits, lacks emergency savings/funding, lacks insurance protection, focused on current needs instead of the longer term needs, etc. Hyperbolic discount tendency is largely at play here. Being economically less viable and out of reach by mainstream financier, alternate financing method such as usage-based services, peer-to-peer and crowd-sourced becomes more appealing. Take-up rates of these services indicates this group’s willingness to go for higher-risk options in order to satisfy consumption needs. Arrival of fintech platforms coincides well with many (if not all) of them. With a strong appetite for debt driven instant gratification, many will be left with little cash for shocks in later life. Such group represents risky but attractive high-interest paying market segments for emerging platform players. The Traditional HNW or UHNW SegmentOver the years, many established investors have grown wary of financial advices delivered by FSI. Clients are no longer satisfied with receiving monthly statements of paltry investment return in their mailbox. Investors want to be able to use their data to look at outcomes in real time. Customers can now quite easily obtain reports and insights that would have previously been hidden or expensive to obtain. Technology is the primary enabler – the use social media, search, and mobile apps during an investment journey, and the proliferation of seamless, omni-channel digital experience lets them interact with service providers anytime, anywhere, and on their own terms. Customer can now shop and compare in the open marketplace to determine which product or service offers the best value for money. This group may stay on course but are increasingly more adept at engaging fintechs, P2P, crowdsourcer, etc. as net financier. Robo-advisors are now gaining grounds and providing really low-cost fees in financial investment areas that require little or no advisory services. The Emerging HNW SegmentWith the old economy disrupted and new class of wealth created, we will be seeing an emerging group of young U/HNW entrepreneurs who is armed with plenty of liquidity and know-how. Having carved out their own existence and survival in a highly volatile and hyper-competitive world, this group of generally young individuals will drive unique wealth management needs – it will be highly international, dynamic and complex in nature. They are probably the least tolerant of time-consuming and complicated processes; have very low trust and are especially vulnerable to exploitative motivation shown by traditional wealth managers, e.g. selective information disclosure and not given proper advise/control of financial decisions. To make it even more challenging, the kind of value they place on life is more subjective than that of the earlier generation. Enablement DrivenAs the ability of robo-advisors and robo-managed investments improves further in the coming years, the need for human intervention will be reduced. Although the promise of ultrahigh returns will be diminished as these programs are algorithmically built to balance risk with returns, it remains attractive as it promises long term growth. This frees up critical human capital to consider and tackle the issue of complex investment needs.

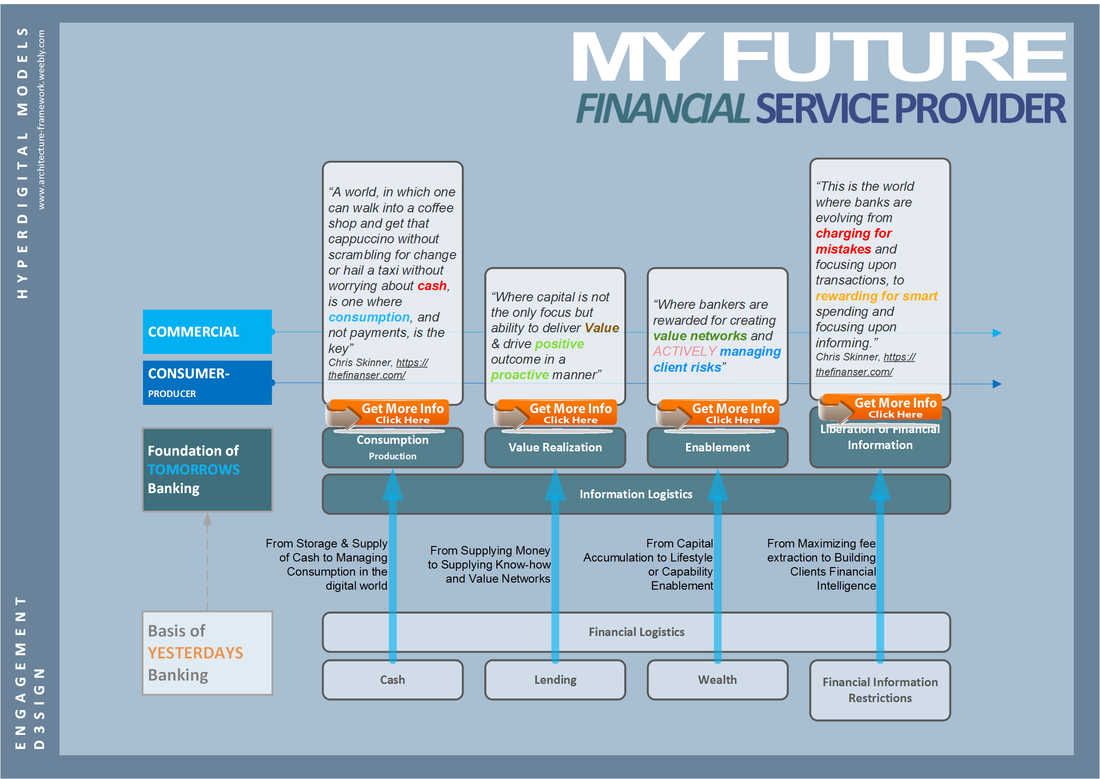

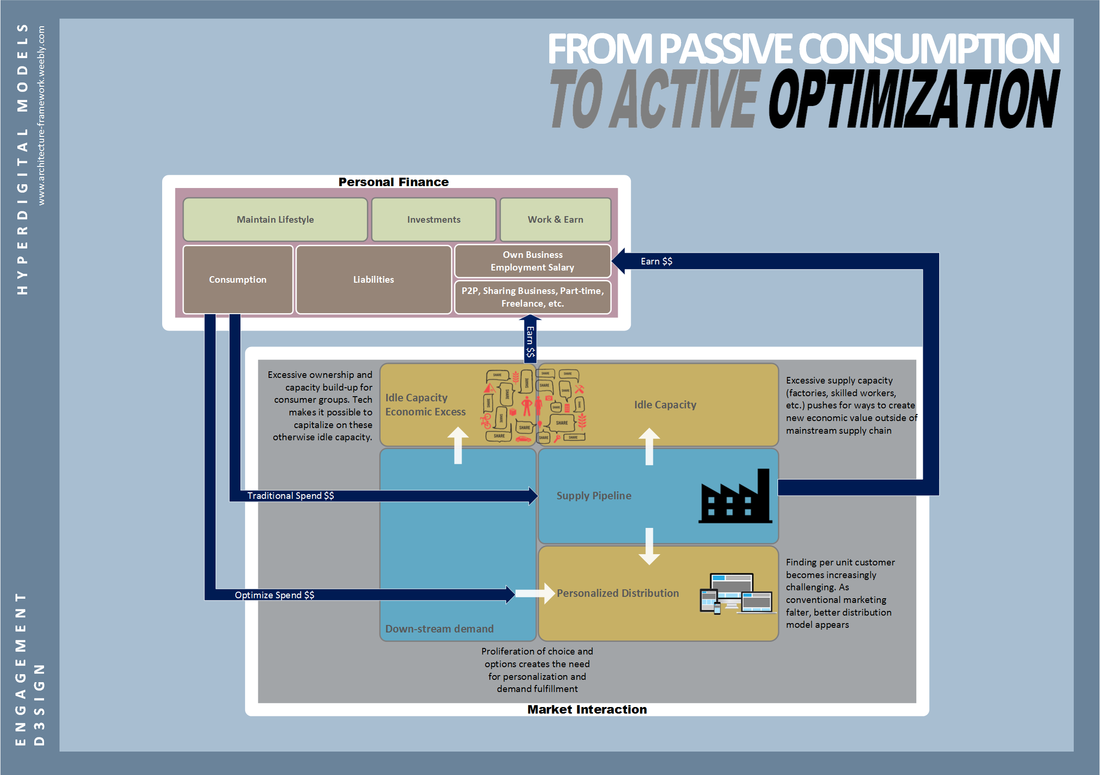

As better endowed generation grows to favor quality of life over wealth and capital accumulation, they will increasingly consider putting their money on social causes, believes and create meaningful impact. Although personal and family financial need is still the main priority, this emerging group takes a mixed world view: one that is driven by the hardship seen in the past decades and one that considers money as just a means to an end. With the passion and intent to drive ‘meaningful change’ this group of like-minded people presents an emerging opportunity. There are already various avenues in the market that caters for their needs. RBC that provides investment products to investors around the world released a survey report in November 2016 entitled Near-Term Uncertainty, Long-Term Opportunity. The report indicates that investors want more information showing how they can use their capital to achieve positive change while growing their assets. To start with there is the impact investment or socially responsible investment platforms. Such investment platforms are spearheaded by either market-benchmarked performers or non-profit believe groups. This would have appealed to HNW individuals and HNW family institutions. Then there is the smaller retail investment groups, the mass affluent who will collectively make smaller impacts. Through such platforms as kickstarters, peer-to-peer and online investment platforms, they too are able to drive impact without sacrificing returns. The shift is small, but the trend may be lasting and will continue to grow. The emerging HNW and UHNW groups will set the investment tones for coming years, one that is bound to focus on the qualitative factors surrounding socially sustainable and regenerative wealth. Equipped with A.I., robotics and wealth management expertise, the generation seeks not just returns but a platform that 'enables' them to realize their own world vision. FROM CONSUMER LENDING TO CONSUMER VALUE REALIZATIONAs we slowly move away from the pain of handling physical cash, transaction will eventually be a matter of digits and numbers. When that happens, the net positive or net negative effect of performing that transaction becomes more important than the transaction itself. This presents a profound shift int the mindset of and created a new generation of 'Prosumers'. We have since moved away from passive consumption to one that is continuously optimized and also active in a lot of ways. For instance, sites and services such as ride-sharing, Airbnb, Kickstarter, etc. is also turning professional consumers into producers. Idle hands, idle capacity and idling creative bunches now have the means to generate incomes. The mainstream economic pipe have since spawned the following two hyper-growth engines:

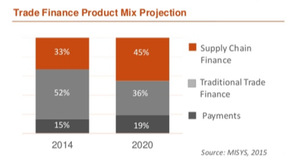

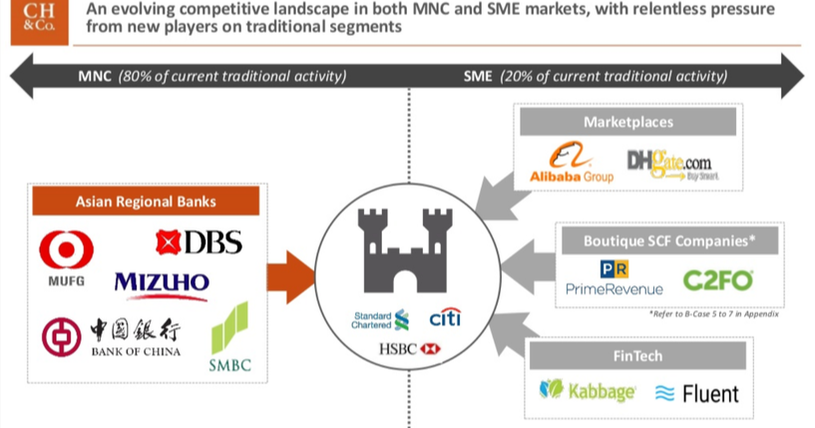

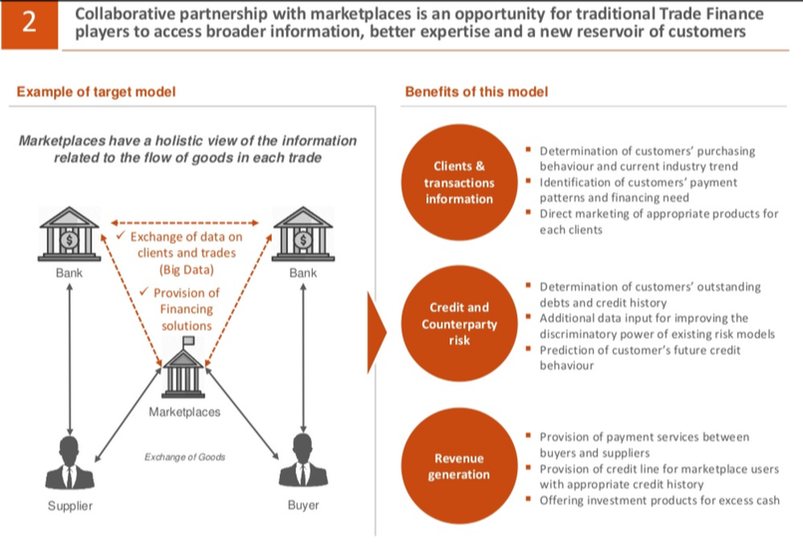

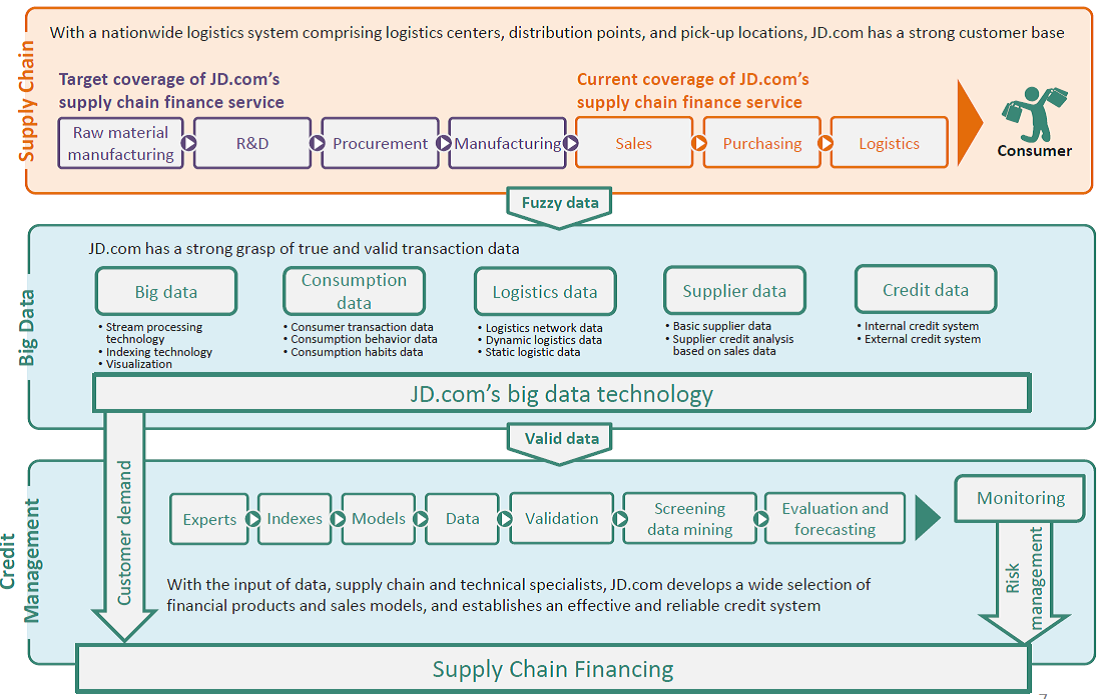

Finding a way to lend to this new ‘prosumer’ group becomes challenging. In such scenario, it is not just cash influx they seek, but the net value exchange they get out of trading or transacting. The challenge for bankers grows as mainstream economy loses share of dollar to this new offshoot market. This is where the e-commerce marketplace players will increasingly find itself in the right spot……. FROM COMMERCIAL LENDING TO BUSINESS OUTCOME REALIZATIONAs to commercial lending business, today’s downstream SCF (supply chain financing) innovators mostly takes advantage of the scale and ability of e-commerce platform to move goods from supplier to end-customer to generate healthy share of account receivables, a feat that traditional financier are unable to accomplish as they have always separated the 3 components: 1. Logistics of Goods – Buyer responsibility 2. Logistics of Information – Physical document trace needed by bankers 3. Logistics of Money – Key focus of banker On top of that, they are also able to lower inventories as they can rely on more accurate demand data supplied by e-commerce. With SCF projected to continue grow over that of traditional trade finance, it is important that bankers as a source of financing take heed: Collaborative SCF (Source: Source: https://www.slideshare.net/CH_APAC_Marketing/trade-finance-in-asia-embracing-the-future) As a result of these platform and through internet ecosystem, innovative disruption is now finding itself swimming upstream. For example, Zhong An insurance helped SME free up working capital by providing return insurance where previously a hefty deposit is required for these merchants to ship on Alibaba platforms. Bankers limited response have been to reduce operating cost, reduce capital cost & credit risk exposures by fostering partnership with marketplace players, e.g. with competing players like Alibaba. In this position, banks will effectively be the payment pipes to release funding and bridging from a KYC, regulatory and currency standpoint. While much of the disruption is happening for marketplace driven demand chain, there are still sizeable supply-driven and upstream financing requirement. These are more industrial level and larger scale financing needs that is still being fulfilled by bankers. It is in this space where the scope for cost, risk and capital requirement reduction is highest by utilizing technology. Bankers can take a leaf from the strategy chapters of e-commerce players in building the necessary infrastructure that will lay the foundation for more accurate risk management and efficient payment services to their client. Sample operating model can be obtained below (Amazon & JD) “Amazon Lending offers short-term business loans ranging from $1,000 to $750,000 for up to 12 months to micro, small and medium businesses selling on Amazon to help them grow their business…… Traditional lenders shied away from small merchants after the 2008 financial crisis, which created an opening for other sources of financing, including marketplace lenders and other FinTech companies. Amazon has the advantage of being less-tightly regulated than banks and having near real-time data on sellers' businesses and access to their customer reviews. Having this wealth of data minimizes credit risk and is quite important in deciding whether to make a loan.” Source: https://www.cnbc.com/2017/06/16/amazon-plans-to-crush-small-business-lending.html "Supply Chain Finance (Jing Bao Bei): In short, JD's direct sales suppliers sell products to JD, JD then includes these products on its balance sheet under inventory, and expensed on its liabilities under accounts payable, around 40 days payable. After an estimate of 40 days, JD will pay back its suppliers after selling the products. Today, JD doesn't wait 40 days, and will pay suppliers on the day it receives their products. In return. JD will receive 40 days' worth of interests. For suppliers, faster payment means more cash to expand. For JD, it will receive extra income from interests. In terms of accounting, accounts payables will be offset by loans outstanding, with accounts receivable days down by around 5 days. JD disclosed in its 2014 annual a supplier loan balance of 1.5 billion yuan, 15 times its 2013 loan balance of 100 million yuan.” JD's Supply Chain Finance Service (Source: Fung BI: https://www.fbicgroup.com/)

Other than keeping our money safe and earning diminishing interest returns, the ability to perform transaction and make payments is one of the key reason we choose to deposit money into a particular bank. Banks earn fees from various mechanisms such as overdraft interest, overdue interest, and card interchange fees, payment fees, late charges, etc. These fee-earning schemes gets baked into the likes of payment services, personal loans, micro-credit loans, hire purchase services, instalment services, etc. allowing banks to build a steady base of both interest and fee paying customer. Regulator and technology are now dismantling the tight integration between payment, servicing and deposit accounts. Customers are now open to enjoy the best of these individual services outside of a single bank / service provider. Disintegration of these service bundles is beginning to make banks less attractive and puts pressure on margins when they have to compete on pure play basis, often times using cross-service subsidies or direct discounts.

Today, hyper-scale e-commerce companies such as Amazon and Alibaba have a major share of the retail transaction market. Of late, through its Prime offering, Amazon have successfully turned consumption into repeat subscription funnel. Such moves (and many others to come) may mean one day these players can easily offer competing FI-related services such as small deposits, lending and payment services. Their effective engagement model focusing largely on value extraction and value realization platforms meant they are capable of owning and growing customers day-to-day consumption needs. The ambition and appetite of these technology savvy companies seems insatiable and unstoppable (source: https://thefinanser.com/2014/03/data-wars-why-google-apple-facebook-and-amazon-will-eat-the-bankers-lunch.html). Consider the strategic decisions by these players have already made as far back as 9 years ago:

Some of these services have the unintended effect of turning banks into a ‘dumb pipe’ where customer engagement is further from the moment of truth. Without the engagement, useful data becomes unavailable and may cost banks money to possess in the future. Others are forced and belated reaction by banks to reorganize their services around meaningful customer needs. Yet, the worst kind of actions are the ones that gives valuable data away for short term and temporal returns. There is a sense that a lot of the efforts offered too little too late to reverse the longer term declining trends for bankers. What is missing then? I personally think bankers are largely still grappling with the right operating model in the emerging digital future. A lot of these experimentations are wild shots and often times, desperate media shout outs. They lack of strategic business alignment; poorly designed for learning and experimentation; ill-focused on monetization and not positioned for sustained digital advantage build-up. To understand where bankers are lagging it is worth taking a look inside the actual disruption, i.e. the pace, scale, capabilities and depth of relationship non-banking players are fostering with their customers. E.g. how hyper-digital players continue to bridge the gap and build capabilities for their growing customer base. To ensure sizeable economic benefits are passed on to their customers, they will drive various value-driven customer engagement initiatives at very large scale. This creates attractive value-proposition to customer and in turn attracts capital for continued expansion. Such customer related value initiatives includes:

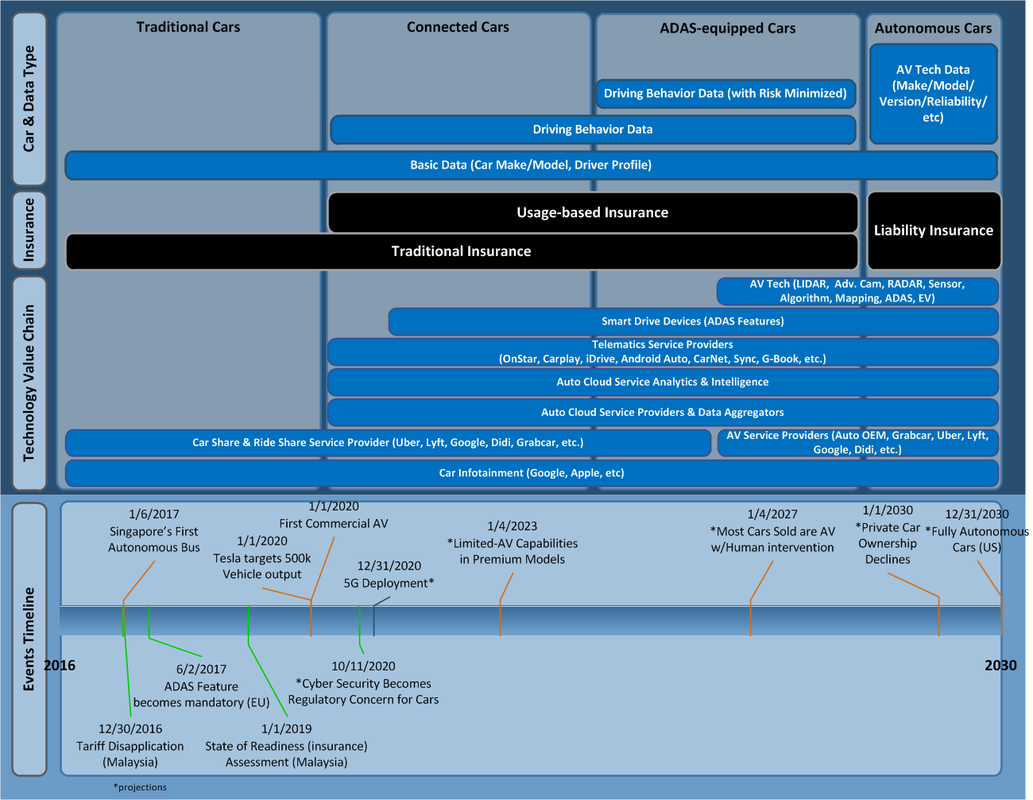

As you read through the list above, you find little that a bank can offer. Bankers may be caught in a difficult position as they are not e-commerce players and are not allowed to take excessive risk with their clientele’s deposits. Which is probably why China and Singapore government might consider (or is already) allowing bankers there to increase participation in certain non-banking type of risk taking. Other bankers are experimenting with “Banking Inside” approach similar to what Intel has done with its widely successful “Intel Inside” campaign. The approach of building Banking-as-a-Service business model is something fairly new and will take time to prove viable. Banks need to build a sizeable ecosystem and an extensive knowledge of their partner/customer in order to become a viable core platform (e.g. see BBVA’s approach to API). It is however, limited response from the banking community. They are largely taking a fringe position from core innovation happening in the actual market place. China is already providing the world a glimpse of what is going to happen to traditional banking in the face of relentless innovation pursuit by tech players there. For example, news headline such as: “China’s Banks lost $22B to Alibaba and Tencent in 2015, But that’s not their Biggest Problem”. Source: https://www.forbes.com/sites/zennonkapron/2016/03/06/china-banks-lost-22b-to-alibaba-and-tencent-in-2015-but-thats-not-their-biggest-problem/#4f4e69ae6094 Things will get worst not just for bankers but for other retailers and brand owners once voice or image based search comes into play as it offers unprecedented opportunity for these tech players to both harvest data and engage customers. As these AI’s build trust and advancements, customer will grow more comfortable and dependent on built-in recommendations to help make day-to-day consumption decisions. Such gatekeeper devices, being imageless and textless, will essentially mask away complexity associated with the traditional brand medias and turn consumption into ‘noise-free’ and ‘frictionless’ experience (source: L2's Scott Galloway’s presentation here: https://www.youtube.com/watch?v=GWBjUsmO-Lw). In this scenario, most brands (banks included) will become mere ‘dumb pipes’ of goods and services, all to the advantage of marketplace platform innovators. The relief is, banks are not alone. "While standalone telematics insurance solutions have been in various markets for a while, data from built-in car sensors and systems will be part of a new generation of real-time motor insurance in future. Today, emergency rescue services can be alerted automatically about location and severity in case of an accident. In future, health insurance companies would be notified, first estimations about damaged car parts can be transmitted to insurance companies and repair shops in real-time while new black box generations will allow loss adjusters to better understand the circumstances of the accident" - Mr. Fang, as the Chief Underwriting Officer, PICC P&C (source: munichre.com) Players in the Auto industry (i.e. OEMs and insurance providers) are bracing themselves not only for the impact of regulatory changes but also the larger shift in the industry caused mainly by technological advancement. The ASEAN region will likewise be disrupted as early as 2020 and the local market players must respond or become irrelevant as the last wave of traditional car refresh projected to take place post-2030 in more advanced countries. As the value shifts, previously unheard of players will become prominent in the auto industry such as cloud service providers in the form of SaaS and smart device OEMs.

For the insurance sector, one of the major push for deregulation (in Malaysia) has been the unsustainable high third-party claim rate and theft rate. Regulators have opted for a phased approach having in mind the price hike that will be triggered on these auto-insurance policies. There are substantial barriers (both structural and social factors) to overcome , For example, the perceived higher average car age and the lack of capabilities of insurance players to offer risk and behavior adjusted insurance policies. The higher retained value of aging car (up to 40%, source: freemalaysiatoday.com) presents a socio-economical challenge to regulators who wants to make meaningful and socially inclusive regulatory change. Steps needs to be put in place to change this as these high-risk vehicles will become a drag to the entire industry. Even though the impact of Self-driving car is not going to be felt in another 10 year or so the opportunity to change and adapt is right here and right now. Regulator plays pivotal role in driving this change. Players who are responding to rapid market shift can best do so when working closely with the industry association and regulators - which best explains why the current MY round of tariff deregulation is mostly consultative and in step-phases. NOTE: This is a quick take of the auto and auto insurance market, with more focus on the Malaysia side of the market as well as projected technology evolution. The timeline data and dates are mostly projections from multiple unverified sources. “Alibaba has zero branches, it’s got no infrastructure. Despite that today it is doing everything a bank does: it raises money, it lends money, it does payments.” said Piyush Gupta, Chief Executive DBS Bank. While the media frenzy is on Fintechs, CEO of DBS may have a point: Banks might have overlooked fast emerging partners that is also fast becoming new digital competitors. As of now, the obvious ones are: 1. Telecommunication Service Provider who have access to virtually every accountable citizen in the world through their use of mobile phones 2. Large retailers raising their own capital and launching their own banking services, e.g. Walmart and potentially Starbucks 3. M-Commerce, E-Commerce giants taking advantage of mobile disruption to expand into virtually every territory, e.g. Alibaba and Amazon Of particular interest to this article is how the rise of M-commerce giants have been seen as an imminent threat by bankers. Riding on the back of mobile phone and mobile data consumption growth, e-commerce is on an accelerated growth path. E-commerce players have been building digital capabilities and expanding beyond e-commerce itself. This threatens traditional business models. E-Commerce Business Model and DriversIf the threat is anything real, then, this author believe that it is fundamentally a business model and platform/ecosystem warfare. E-commerce starting out from marketplace platform have been building out other platforms. It continues to do so at a speed and scale that was not possible with traditional business model. Banks on the hand, continues to grapple with regulatory and business model limits. Any attempt to scale out and scale big is accompanied by heavy doses of regulatory oversight. It is a business model simply not suited to take on that of the e-commerce companies.

Bankers reaction to the threats from e-commerce players range from mild to severe:

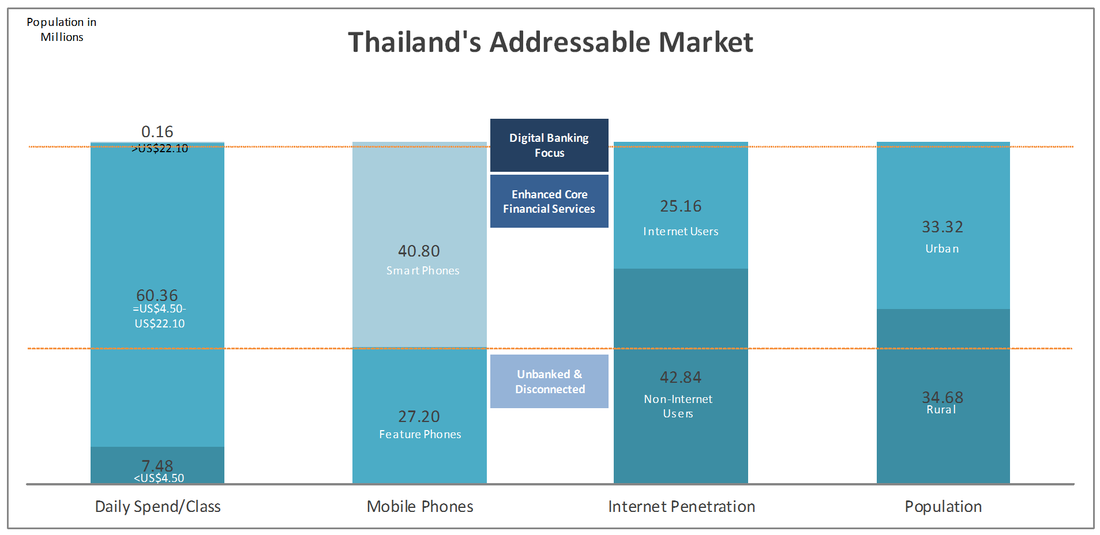

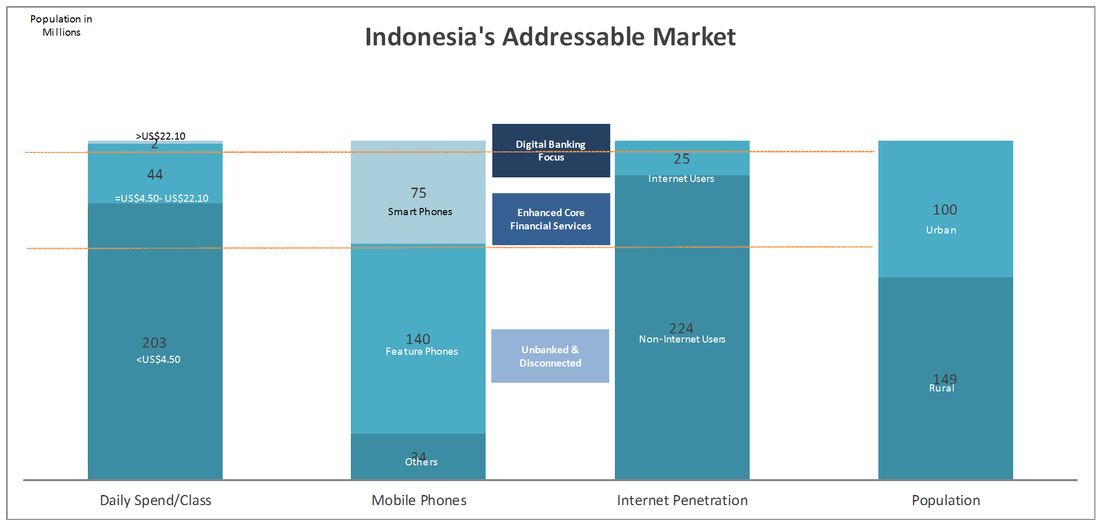

1. Move in to the competitors turf, i.e. Setup their own e-Commerce engine 2. Consolidate and re-architecture the physical branch experience. 3. Promote more transaction through their existing channels by way of marketing, heavy discounting and loyalty rewards 4. Establish Partnership with other platform players, e.g. Apple, Media Company and Telco 5. Acquire synergistic Fintech startups; launch Fintech lab or accelerator hubs; launch Hackaton. The ASEAN region's leading banking player is already in the midst of retrofitting their banking system to take advantage of cloud and mobile analytics while at the same time initiating a slew of fintech innovation lab or hubs. The formula looks strikingly similar across the region with minor differences from one bank to the other in terms of digital banking approach and local needs. This short article gives a glimpse of the addressable mobile-FSI market by considering some data points from Indonesia and Thailand. I've included in the chart a line break (i.e. smartphone users) to indicate the feasible approach to mobile banking by way of either enhanced core offering or digital banking offering or via an underbanked/unbanked offering approach. The approach will be further discussed in a separate article. (As shown in the charts below) The larger middle-class population in Thailand (in percentage terms) is also supported by larger penetration of smartphones and active internet subscription. In Indonesia, the market is largely rural with lower percentage of smartphone and internet penetration versus that of Thai. Indonesia has a huge installed base of feature phone that provides pre-installed social media apps such as Facebook. This makes for an immediate split in current addressable mobile banking segment - those using feature phones versus smart phones. Although it is estimated that Indonesia's active smartphone users will surpass 100 million mark by 2018. The size of the addressable mobile-FSI market will further be accelerated if Indonesia branch-less banking initiative actually improves financial inclusion through the using of mobile phones. It is worth noting that a large portion of poor in Thailand is urban poor versus Indonesia's predominantly remote rural poor. Thai's poor is largely an accessibility issue rather than infrastructure availability issues. The lack of credit information and know-how might have shut some of the poor off from financial inclusion entirely.

References: http://www.kasikornbank.com/EN/WhatHot/Pages/TheWisdom2015.aspx http://www.worldbank.org/ https://www.worldwealthreport.com http://www.slideshare.net/yozzo1/thailands-telecom-market-information-q1-2015 http://www.kpmg.com/ID/en/IssuesAndInsights/ArticlesPublications/Pages/FinancialInclusioninIndonesia.aspx We know that a slew of tech enablement and mass adoption triggered a sort of 'renaissance' for Fintech companies. But what drove us to seek alternate financial services - both from a consumer and investor standpoint? What benefits do they bring? Other than expecting a financially sound, secure and stable system, these market forces is reshaping the financial services landscape:

TOWARDS ZERO-COST TRANSACTION Although it is generally understood there are cost associated to enabling transaction (i.e. infrastructure investments, labor, payment services, etc.) customer do however expect the average cost per transaction to continue to fall or gets abolished. This is on the basis of lower cost technology availability, market pressure and shifting industry practices. This gave rise to a steady movement towards zero-cost transaction. Already evident in payment solution offerings and remittance business, the trend is now spilling over to traditional banking line: In March 2015, European Parliament have voted in favour of a bill to cap the fees at 0.3 per cent of the value of transactions on credit cards and 0.2 per cent for debit card payments across borders. Some comparison of the cost per transaction can be found in the following: https://www.formstack.com/payment-gateway-comparison DEMOCRATIZED INFORMATION SERVICES Secondly, You can generally observe that there is some information element in each and every service that we seek. For example:

ALTERNATE FUNDING AND INVESTING PLATFORM Thirdly, banking is also about making funding available in ways that was not possible by traditional bankers. Think insurance for instance, the key driving need is risk management by having the right information and emergency funding in case of incident. This have traditionally been dependant on third-party specialist we know as insurance companies. With the rise of GPS, early warning systems, telemetry, IoT and other technology enablements, it is becoming increasingly possible to actively manage risk and relook at cost of managing risk differently. As to funding, there are multiple alternatives too ranging from peer-to-peer to reinsurance funding to trust funds. As Schumpeter wrote about Friendsurance, a website that is now considered the pioneer of what one day may be called “social” or “person-to-person” (p2p) insurance in Economist: “Isn't an insurance essentially a social network to share risk?” SHOULD I BANKS OWN A FINTECH? Other than frantically trying to gobble up Fintech startups (which may not lead to much synergies), bank should challenge itself in working towards (given that financial system stability is still a priority):

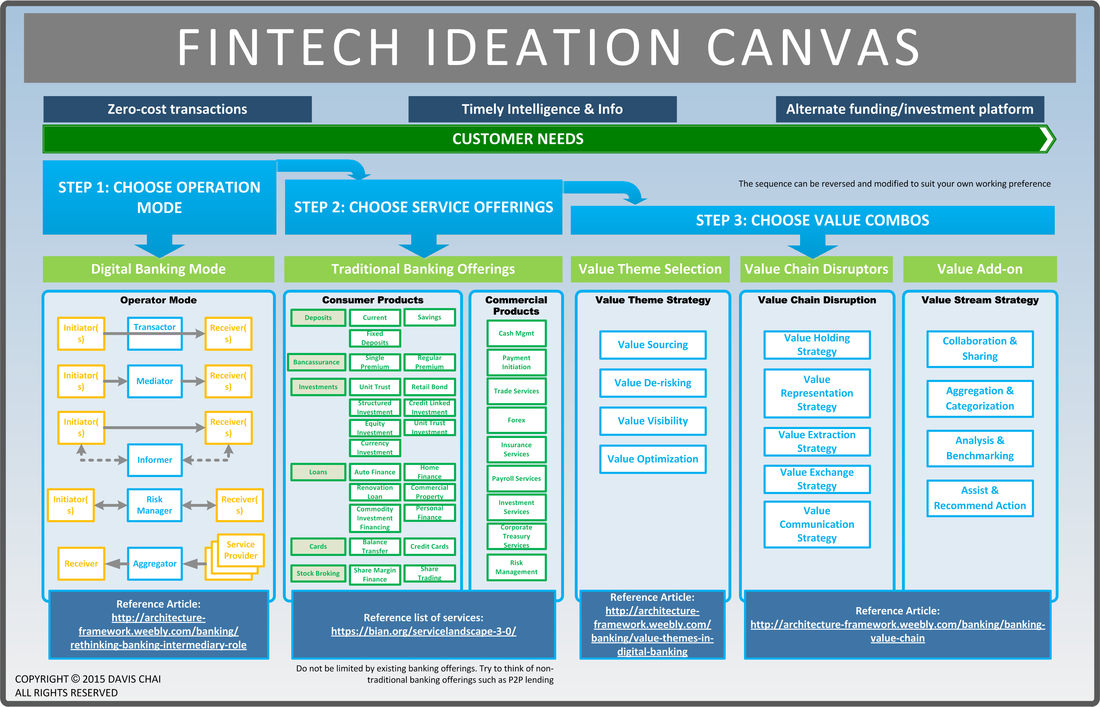

A BETTER FINANCIAL INTERMEDIARY It is not then not a pursuit to disintermediate bank but an effort to strengthen the intermediary role of financial service providers - be it bank or fintech. Bank's role in most of these financial services should be justified not institutionalized. And yes, banking needs to be regulated - that includes Fintech and banks too. NOTE: The "Fintech Ideation Canvas" has been updated with additional guiding info on customer needs. To all budding Fintech entrepreneurs and enthusiasts, here is a fintech service ideation canvas for you to kick start that million dollar business!

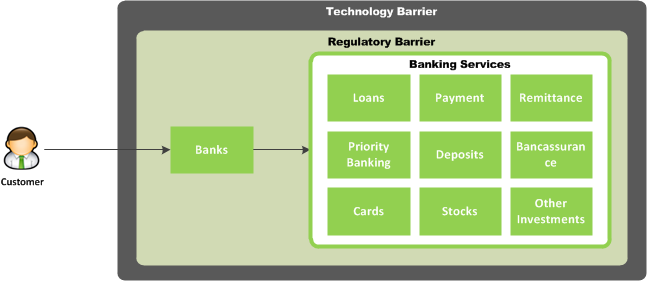

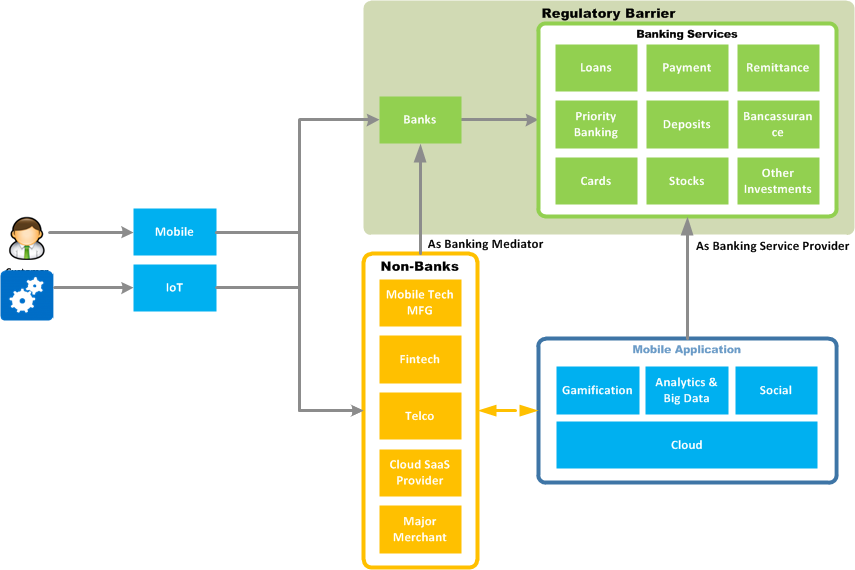

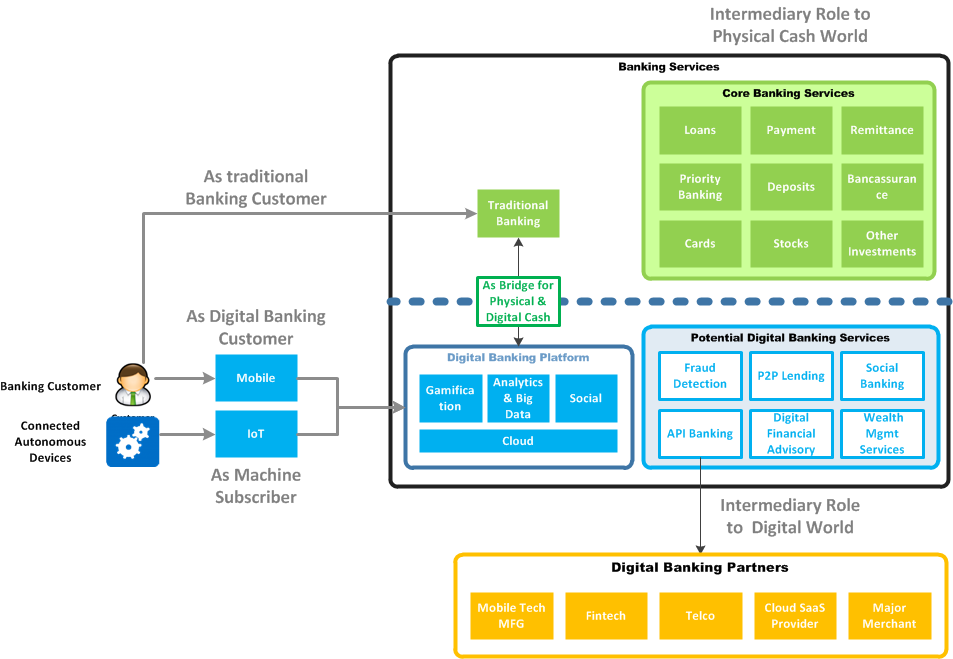

Up until the early stages of internet boom, bank still enjoyed near monopoly of access channel to all banking related services. Most banking customers rely on such channel services as banking kiosks/branches, cards/POS terminals, ATM, banking e-portal, etc. to gain access to financial services. Technology advancement have since made it possible for customers to receive banking services in their own convenience. Whilst the bulk of the mobile technology advancement occurred in the consumer space, adoption by banks is largely fashioned around traditional business lines. Thus limiting its full potential. As banking customer increasingly embrace digital lifestyle, banks appeared to have lagged further behind. Non-banks sees this as open opportunity to offer banking related services in ways that is not offered by banks. Banking Technology Barrier is in a peculiar way, lowered for non-banks but raised for banks (mostly due to the lack of an effective approach to digital banking). The world of banking is thus opened up to non-banking competition. These opportunistic players were quick to adopt technological advances made available to both consumer and to themselves as service provider. These non-bank players either enters as intermediary to banks (e.g. Apple Pay, Square, Billguard, Google Wallet) or provide certain forms of services in direct competition to banks (e.g. LendingClub, Bitcoin, Venmo). Cloud services are being consumed by both enterprises and end-users as a way to leapfrog technology adoptions (changing from tech purchasing to tech consumption). To further capitalize on the technology gaps opportunity, non-banks uses Value Stream approach - which encompasses the ability to: 1. Collect, aggregate and categorize information 2. Analyze, benchmark and offer intelligent insight into information 3. Offer collaborative and sharing functionalit 4. Drive behavior by assisting and recommending actions Rather than become sidelined by non-bank digital players and missing out on revenue opportunity, banks should develop a more holistic digital banking strategy. This strategy does not necessarily need to alienate traditional banking services but complements or takes advantage of it. Banks should take this opportunity to consider its strategic banking touch points and focus on the emerging banking role as financial intermediary in the digital world. More importantly, banks should use this positioning as a way to learn and evolve its value creation capabilities. Banks can bridge the digital gap with the physical cash world. There is already a growing trend of ATM machines being used to interact with digital world - e.g. SMS cash withdrawal, use mobile phone for authenticating. For housing loan and consumer credit, banks can consider alternative funding source - e.g. collaborative funding or P2P in short. They could use technology to assist in onboarding new customer, client repayment handling, personal finance management purposes, etc. They could also make good use of core capabilities such as in fraud detection and risk management. These too can either be exposed via banking API for merchant/partners to subscribe and use or be embedded as part of transactional banking function much as what BillGuard has done. Banks should embed transactional banking function as part of an-Open API service for non-banks to use. By doing so, banks would be plugging themselves in to a larger digital ecosystem. To the end-user, services such as PFM and private wealth management from partner companies will become more useful when they have access to banking data.

|

AuthorDavis Chai is an Architect in the FSI industry for the past 10 years. His career involvement in the industry informed his work and allowed him to contribute to this blog. Archives

September 2017

|

RSS Feed

RSS Feed